maryland ev tax credit 2020

Electric car buyers can receive a federal tax credit worth 2500 to 7500. 1 2019 fiscal year 2020 when additional funds become available.

He and mcgill took advantage of the incentives available for their purchases a federal income tax credit of up to 7500 plus a 3000 state excise tax credit that was.

. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle. Maryland EV Tax Credit Major Funding Increase Proposed. SB 277 Clean Cars Act of 2020 Extension Funding and Reporting.

February 11 2020. The credit is for 10 of the cost of the qualified vehicle up to 2500. The Clean Cars Act.

The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the. The total amount of funding currently available for this rebate program in state fiscal year FY 2022 7122- 63023 is up to 1800000. For more information about claiming the credit see the Internal Revenue Service IRS Plug-In Electric Vehicle.

0 of the first 8000 of the. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to. Maryland EV Tax Credit Status as of June 2020.

Maryland EV Tax Credit Extension Proposed in Clean Cars Act of 2021. Excise Tax Credit for Plug-In Electric and Fuel Cell Vehicles As a reminder the 6 million funding authorized by the Maryland Clean Cars Act of 2019 HB 1246 as an excise tax. January 22 2020 Lanny.

Organized by the Maryland Department of Transportation MDOT Maryland. Maryland ev tax credit 2020 wednesday april 27 2022 edit. January 5 2021 by Lanny.

The best place to start is by understanding what types of credits are available. Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit Beginning July 1 2023 qualified EV and FCEV purchasers may apply for an excise tax credit of up to 3000. Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic.

Effective July 1 2023 through June. Up to 26 million allocated for each fiscal year 2021 2022 2023. Governor Hogan is committed to fully funding the Plug-In Electric Vehicle Excise Tax Credit in next years budget pending.

Tax credits depend on the size of the vehicle and the capacity of its battery. Upon purchasing a new EV or PHEV the federal tax credit can be applied to a buyers tax liability for the year and. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the.

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula. Marylanders who purchased a plug-in electric vehicle since funds were.

Maryland Needs To Keep Its Electric Vehicle Credits Rolling Baltimore Sun

Here Are The Cars Eligible For The 7 500 Ev Tax Credit In The Inflation Reduction Act Electrek

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Get A Tax Credit For Buying An Electric Vehicle Updated List 2023

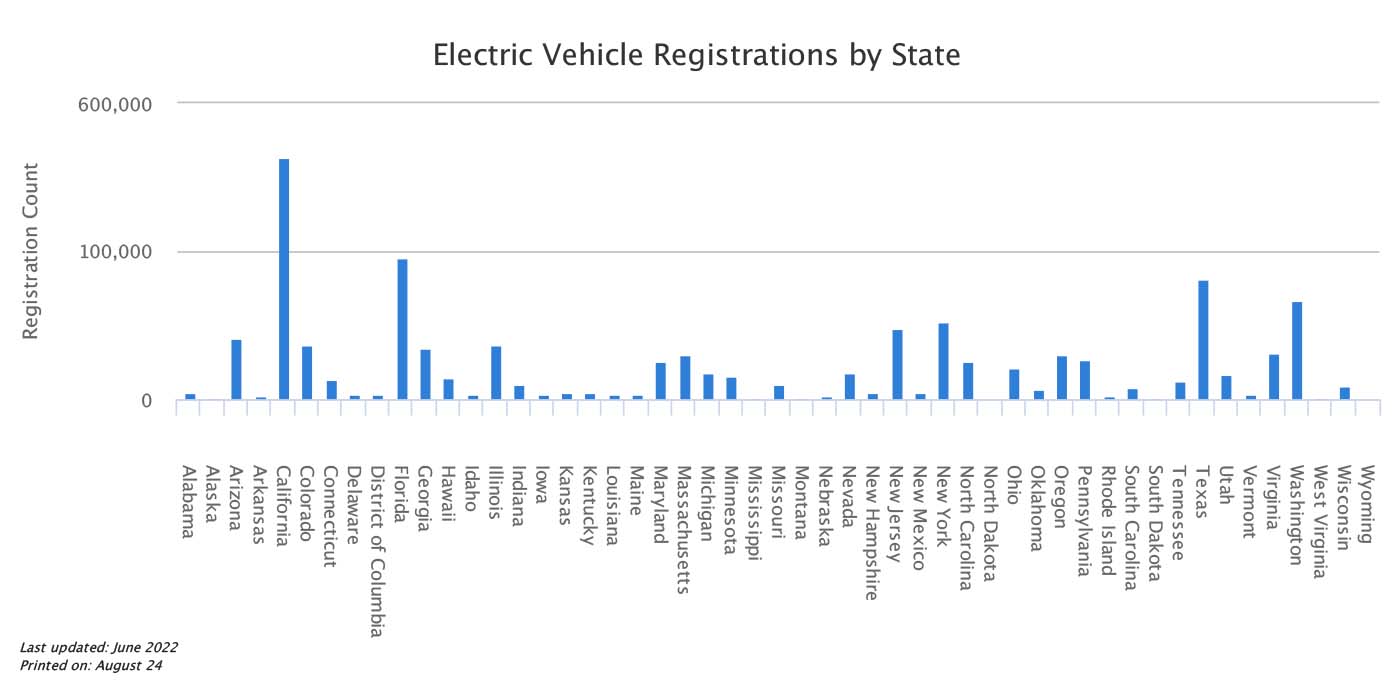

Current Ev Registrations In The Us How Does Your State Stack Up And Who Grew The Most Yoy Electrek

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

2022 Ev Tax Credits In Maryland Pohanka Automotive Group

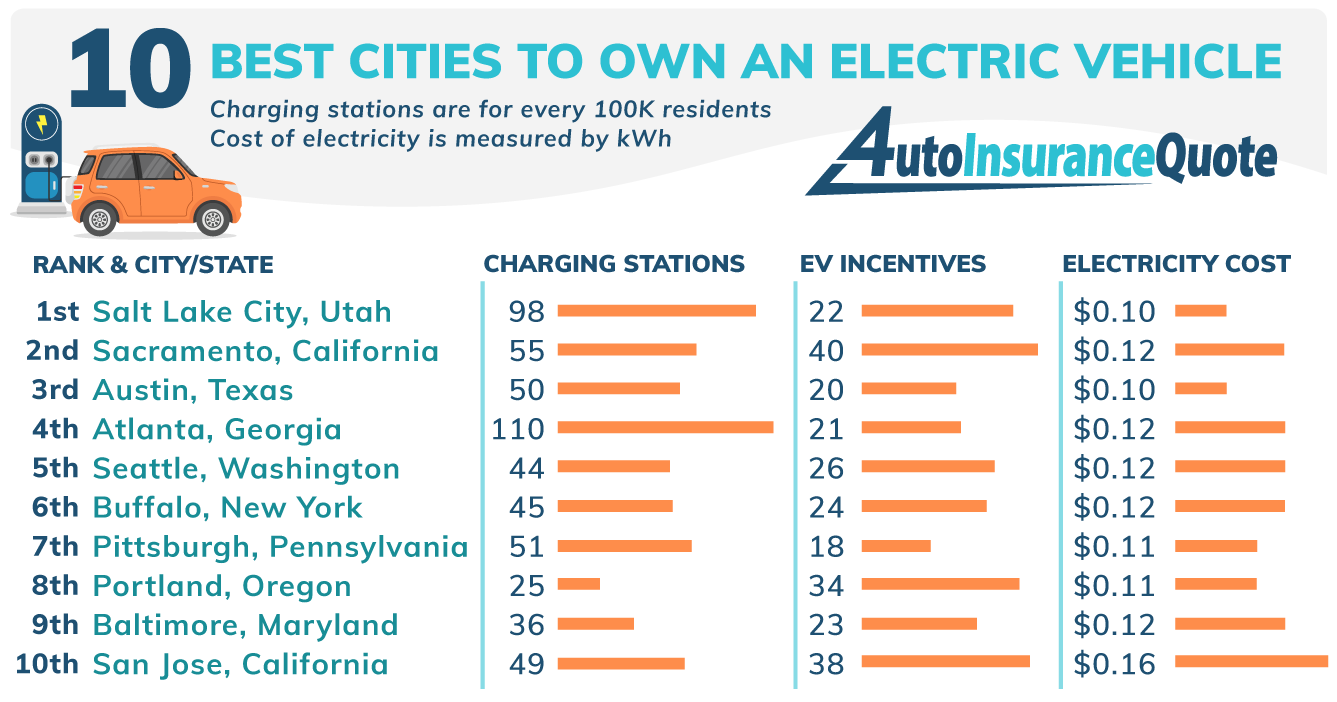

10 Best Cities To Own An Electric Vehicle 2022 Report 4autoinsurancequote Com

Maryland State And Federal Tax Credits For Electric Vehicles In Capitol Heights Md Pohanka Honda In Capitol Heights

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Maryland State Ev Tax Credit Has Received Some Funding R Electricvehicles

Eight State Coalition Plans Incentives For Zero Emission Vehicles The Washington Post

Electric Vehicles Should Be A Win For American Workers Center For American Progress

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Hyundai Of Capitol Heights